If you are losing sleep over volatility driven by a cascade of disheartening news, it may help to remember that the stock market is historically cyclical.

The longest bull market in history lasted almost 11 years before coronavirus fears and the realities of a seriously disrupted U.S. economy brought it to an end.

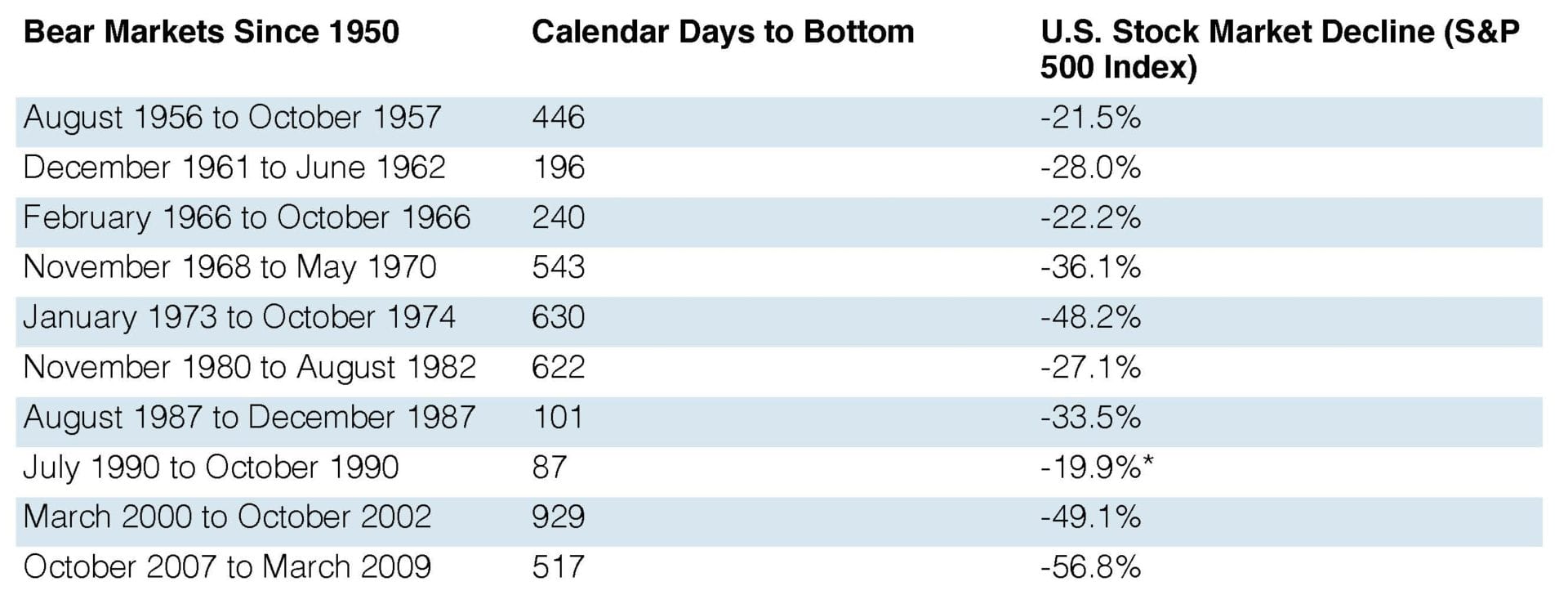

If you are losing sleep over volatility driven by a cascade of disheartening news, it may help to remember that the stock market is historically cyclical. There have been 10 bear markets (prior to this one) since 1950, and the market has recovered eventually every time.

Bear markets are typically defined as declines of 20% or more from the most recent high, and bull markets are increases of 20% or more from the bear market low. But there is no official declaration, so in some cases there are different interpretations regarding when these cycles begin and end.

On average, bull markets lasted longer (1,955 days) than bear markets (431 days) over this period, and the average bull market advance (172.0%) was greater than the average bear market decline (-34.2%).

*The intraday low marked a decline of -20.2%, so this cycle is often considered a bear market.

The bottom line is that neither the ups nor the downs last forever, even if they feel as though they will. During the worst downturns, there were short-term rallies and buying opportunities. And in some cases, people have profited over time by investing carefully just when things seemed bleakest.

If you’re reconsidering your current investment strategy, a volatile market is probably the worst time to turn your portfolio inside out. Dramatic price swings can magnify the impact of a wholesale restructuring if the timing of that move is a little off.

A well-thought-out asset allocation and diversification strategy is still the fundamental basis of good investment planning. Changes in your portfolio don’t necessarily need to happen all at once. Try not to let fear derail your long-term goals.

The return and principal value of stocks fluctuate with changes in market conditions. Shares, when sold, may be worth more or less than their original cost. Asset allocation and diversification are methods used to help manage investment risk; they do not guarantee a profit or protect against investment loss. If you are losing sleep over volatility driven by a cascade of disheartening news, it may help to remember that the stock market is historically cyclical.

The S&P 500 is an unmanaged group of securities that is considered to be representative of the U.S. stock market in general. The performance of an unmanaged index is not indicative of the performance of any specific investment. Individuals cannot invest directly in an index. Past performance is not a guarantee of future results. Actual results will vary. Source: Yahoo! Finance, 2020 (data for the period 6/13/1949 to 3/12/2020)

Prepared by Broadridge Investor Communication Solutions, Inc. Copyright 2020

IMPORTANT DISCLOSURES Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

Ballast Advisors, LLC is a registered investment advisor under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about the firm, including its services, strategies, and fees can be found in our ADV Part 2, which is available without charge upon request. The opinions expressed herein are those of Ballast Advisors, LLC and are subject to change without notice