Q1 Market Update

Market Overview:

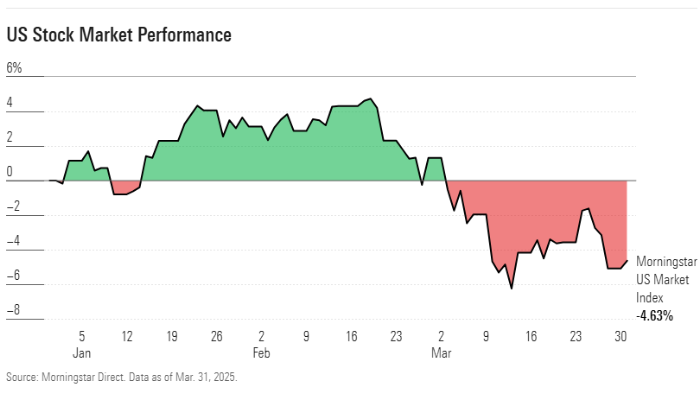

Volatility: The first quarter of 2025 saw renewed volatility, with major indices posting modest declines.

US Stocks: The S&P 500 fell by 4.27%, the Dow Jones Industrial Average by 0.87%, and the NASDAQ 100 by 8.07%. Concerns over trade policies and tariff threats weighed heavily on market sentiment.

International Markets: International stocks outperformed US stocks, driven by what we consider to be strong performance in Europe.

Sector Performance: Technology and consumer discretionary sectors faced sharp losses, while energy, healthcare, utilities, and consumer staples showed resilience. International Markets: International stocks outperformed US stocks, driven by what we consider to be strong performance in Europe.

Bond Market:

Performance: The bond market performed strongly, in our view, with the Morningstar US Core Bond Index gained 2.78% during the quarter. This was driven by falling interest rates across the Treasury yield curve, particularly in the two- to 10-year range.

High-Quality Bonds: Investors sought refuge in high-quality assets amid heightened market uncertainty. Treasury yields decreased, leading to a rally in prices for long-duration bonds like Treasuries and agency mortgages.

Credit Spreads: Credit spreads widened modestly from historically tight levels due to renewed concerns about tariffs and potential recession impacts.

Inflation-Protected Bonds: Inflation-protected bond funds gained 3.87% on average, benefiting from rising inflation expectations and falling Treasury yields.

Economic Overview:

Consumer Confidence: There was a sharp decline in US consumer confidence in the outlook for general economic conditions and inflation. One-year forward inflation expectations rose to 5%.

Personal Income: Wage and salary growth continued to exceed the general rate of inflation, supporting ongoing spending and increased savings. However, lower-income households faced budgetary stress due to higher prices on basic goods.

Employment: Robust job creation was a key factor in economic health, with nonfarm payrolls adding 151,000 jobs in February. However, the broader Household Survey of Employment showed a decline in jobs as the quarter progressed.

Federal Employment: Significant reductions in federal employment and spending were discussed and, in some cases, implemented. This is expected to have a pronounced local economic impact in future quarters.

Tariffs: The dominant economic story of the quarter was tariffs imposed and threatened. Steel and aluminum tariffs imposed in late February increased costs and slowed business activity in some sectors.

IMPORTANT DISCLOSURES

The opinions expressed herein are those of Ballast Advisors, LLC and are subject to change without notice. The third-party material presented is derived from sources Ballast Advisors consider to be reliable, but the accuracy and completeness cannot be guaranteed. Past performance is not indicative of future results. Nothing contained herein is an offer to purchase or sell any product. This material is for informational purposes only and should not be considered investment advice. Ballast Advisors reserve the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual's personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice. Ballast Advisors, LLC is a registered investment advisor under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about the firm, including its services, strategies, and fees can be found in our ADV Part 2, which is available without charge upon request. BAL-24-31