Financial Planning for Life Transitions: Support from Punta Gorda, St. Paul, Woodbury & Charlotte County

Looking for the top financial advisor in Minnesota, St. Paul, or Woodbury? Our expert team of certified financial planners, investment strategists, and wealth managers delivers personalized solutions to help you achieve your financial goals. Whether you need retirement planning, investment advice, or comprehensive wealth management, we connect you with the top financial professionals in your area. Specializing in wealth planning, investment strategies, and financial guidance, our advisors are trusted across Minnesota, St. Paul, Woodbury, and Punta Gorda. Find peace of mind with top-rated advisors dedicated to your success. Explore the best in financial planning and wealth management today and secure your financial future.

Financial planning isn’t just about numbers. It’s about navigating the real-world transitions that shape your life—retirement, starting a business, selling a home, caring for aging parents, or building a legacy for your children.

Across Punta Gorda, St. Paul, Woodbury, and Charlotte County, Ballast Advisors works with individuals and families facing these turning points, offering strategic advice grounded in experience, local knowledge, and fiduciary responsibility.

Retirement: A Transition, Not an End Point

Retirement isn't the finish line—it’s the start of a new financial chapter. Whether you're meeting with a financial planner in Punta Gorda, a retirement planning specialist in Woodbury, or a fiduciary advisor in Charlotte County, the goal remains the same: to create a dependable income stream while protecting long-term assets.

Planning around Social Security, required minimum distributions, healthcare costs, and legacy planning is essential. Our teams across Minnesota and Florida help clients build retirement roadmaps that are both tax-conscious and adaptable.

Moving or Downsizing? Coordinate More Than Just the Move

Relocating, especially during retirement, can trigger major financial shifts. From selling a home in St. Paul to purchasing a condo in Punta Gorda, the right advisor helps you manage cash flow, tax implications, and reinvestment strategy.

If you're working with a wealth strategist in Woodbury or a fiduciary financial advisor in Punta Gorda, their insight goes beyond portfolios—they can help you decide when and how to transition your assets during a move.

Navigating Family Transitions: Inheritance, Gifting & Support

Families often face unplanned transitions: receiving an inheritance, caring for a parent, funding a child’s education. A financial coach in Charlotte County or wealth coordinator in St. Paul can help make sense of the options.

Whether it’s updating your estate plan, opening a donor-advised fund, or shifting your investment strategy, advisors like those at Ballast help you evaluate both the math and the meaning behind big decisions.

Business Sales, Career Changes, and Liquidity Events

Selling a business or navigating a career shift can dramatically alter your financial landscape. A boutique money manager in St. Paul or investment planner in Punta Gorda will look beyond the lump sum and ask: how should these funds be allocated to preserve optionality, fund future goals, and minimize tax impact?

Our team specializes in these life-altering moments—partnering with fiduciary managers in Woodbury and financial experts in Charlotte County to deliver a clear plan for every stage.

Tax Efficiency During Times of Change

Life transitions often come with unexpected tax burdens—capital gains, estate taxes, or higher income during partial retirement. Working with a top fiduciary financial advisor in Charlotte County or a tax-smart investment planner in St. Paul means anticipating these tax events rather than reacting to them.

Whether you’re exploring Roth conversions, charitable giving, or estate structures, our advisors tailor each strategy to your location, income bracket, and family needs.

Why Local Planning Still Matters

While financial markets are global, your life is local. A wealth planner in Woodbury understands the state-specific tax incentives and estate laws in Minnesota. A financial advisor in Punta Gorda knows how to structure withdrawals in Florida’s no-income-tax environment.

If you're in Charlotte County searching for a wealth planning specialist, or in St. Paul looking for a trusted CFP, having someone who understands both your financial goals and your zip code can make all the difference.

Ballast Advisors: Personalized Support, Wherever Life Takes You

At Ballast Advisors, we serve as your financial co-pilot through every transition—whether you're planning your next chapter in Punta Gorda, managing complexity in St. Paul, navigating investments in Charlotte County, or coordinating family wealth in Woodbury.

We integrate the knowledge of:

CFPs and fiduciary managers

Boutique wealth and investment planners

Wealth coordinators and strategists

Financial coaches and retirement advisors

…to provide clarity during uncertain times.

Let’s Talk About What’s Next

Whether you’re entering retirement, experiencing a life transition, or simply want to align your finances with your future, our advisors are ready to help.

If you’d like to discuss your financial questions, please contact us at Ballast Advisors. Our local teams in Punta Gorda, St. Paul, Woodbury, and Charlotte County are here to help you navigate change with clarity, balance, and a plan built around you.

IMPORTANT DISCLOSURES

The opinions expressed herein are those of Ballast Advisors, LLC and are subject to change without notice. The third-party material presented is derived from sources Ballast Advisors consider to be reliable, but the accuracy and completeness cannot be guaranteed. Past performance is not indicative of future results. Nothing contained herein is an offer to purchase or sell any product. This material is for informational purposes only and should not be considered investment advice. Ballast Advisors reserve the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual's personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice. Ballast Advisors, LLC is a registered investment advisor under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about the firm, including its services, strategies, and fees can be found in our ADV Part 2, which is available without charge upon request. BAL-24-31

What to Look for in a Financial Advisor Near You: Punta Gorda, St. Paul, Woodbury & Charlotte County

Looking for the top wealth advisor in Minnesota or Punta Gorda? This guide highlights the most respected professionals in top wealth management across St. Paul, Woodbury, and beyond. Whether you're seeking a wealth strategist in St. Paul MN, comprehensive wealth planning in Woodbury, or a top-tier wealth manager in Punta Gorda, we cover the firms known for their personalized approach, proven expertise, and dedication to high-net-worth clients. Explore wealth management strategies designed to grow and preserve your legacy. Compare leading advisors in Minnesota’s Twin Cities region and Florida’s Gulf Coast to make informed decisions about your financial future with guidance from the best in the business.

When it comes to your finances, where you live matters. Whether you’re preparing for retirement in Punta Gorda, managing generational wealth in St. Paul, or building a business in Woodbury, the right financial guidance should reflect your goals—and your local reality.

Across Florida and Minnesota, individuals and families are turning to financial professionals for everything from retirement income planning to investment strategy, tax efficiency, and legacy design. Here’s what sets top financial partners apart, and what to consider when seeking support in your area.

What Defines a Strong Fiduciary Advisor?

A fiduciary advisor is legally obligated to act in your best interest—but the best ones go beyond compliance. If you're searching for a fiduciary financial advisor in Punta Gorda or a fiduciary manager in St. Paul, you’ll want someone who offers transparency, strategic thinking, and consistent follow-through.

From Charlotte County to Woodbury, more families are relying on fiduciary teams that combine comprehensive planning with objective guidance—whether through fee-based planning, risk analysis, or coordinated estate strategies.

Retirement Planning That’s Built to Last

The best retirement planning today takes into account more than just an IRA balance. Whether you’re in Punta Gorda or Woodbury, planning for retirement means addressing healthcare costs, inflation, income sequencing, and required minimum distributions.

Clients working with firms like Ballast Advisors benefit from region-specific insight—understanding how to optimize their Social Security strategy in St. Paul, or structure retirement distributions in Charlotte County to reduce long-term tax burdens.

Boutique Wealth Management: A High-Touch Alternative

There’s been a clear shift toward boutique money management and boutique wealth planning—especially in areas like Punta Gorda, St. Paul, and Woodbury. Affluent clients increasingly want direct access to their advisors, customized portfolios, and coordinated strategies that integrate tax, legal, and philanthropic components.

Whether you’re working with a money manager in Charlotte County or a wealth strategist in Woodbury, boutique firms offer the advantage of agility, responsiveness, and more time dedicated to your specific situation.

Coaching vs. Planning: Understanding the Difference

If you’re in St. Paul searching for a financial coach, or in Punta Gorda needing a retirement planner, it helps to understand the distinction. A coach helps you develop better financial habits and decision-making frameworks. A planner delivers a more comprehensive roadmap—complete with investments, insurance, taxes, and estate design.

In many cases, Ballast Advisors clients work with a team that offers both: a planning specialist for long-term vision, and a coach for everyday support and accountability.

Why Local Expertise Still Matters

A financial planner in Woodbury understands the tax laws, cost of living, and retirement trends specific to Minnesota. A wealth coordinator in Punta Gorda has experience structuring strategies that address Florida’s estate tax benefits or snowbird lifestyle complexities.

From top CFPs in Charlotte County to investment planners in St. Paul, your financial partner should know how to navigate both your portfolio and your zip code.

Coordinated Wealth Strategies Across Life Stages

It’s no longer enough to have a single advisor. Many clients need a wealth coordinator, a fiduciary manager, and a financial strategist—often working together. That’s why Ballast Advisors provides team-based planning designed to evolve with your life’s milestones: career growth, retirement, legacy transitions, and more.

Whether you’re a retiree in Punta Gorda, a professional in Woodbury, or a family steward in Charlotte County, working with a team that understands both the technical and personal aspects of wealth is essential.

Final Thoughts

Choosing the right financial professional is about more than credentials—it’s about trust, access, and shared understanding. Whether you're seeking experienced guidance in Punta Gorda, refining your plan in St. Paul, or launching a multi-generational strategy in Charlotte County or Woodbury, the right partner can help bring clarity to complexity.

Ready to Talk?

Whether you’re seeking experienced financial guidance in Punta Gorda, looking to refine your wealth planning strategy in St. Paul, or simply want a second opinion on your current plan, Ballast Advisors is here to support your goals.

If you’d like to discuss your financial questions, please contact us at Ballast Advisors. Our teams in Punta Gorda, St. Paul, Woodbury, and Charlotte County offer personalized planning rooted in fiduciary care, thoughtful analysis, and a deep understanding of your local landscape.

IMPORTANT DISCLOSURES

The opinions expressed herein are those of Ballast Advisors, LLC and are subject to change without notice. The third-party material presented is derived from sources Ballast Advisors consider to be reliable, but the accuracy and completeness cannot be guaranteed. Past performance is not indicative of future results. Nothing contained herein is an offer to purchase or sell any product. This material is for informational purposes only and should not be considered investment advice. Ballast Advisors reserve the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual's personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice. Ballast Advisors, LLC is a registered investment advisor under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about the firm, including its services, strategies, and fees can be found in our ADV Part 2, which is available without charge upon request. BAL-24-31

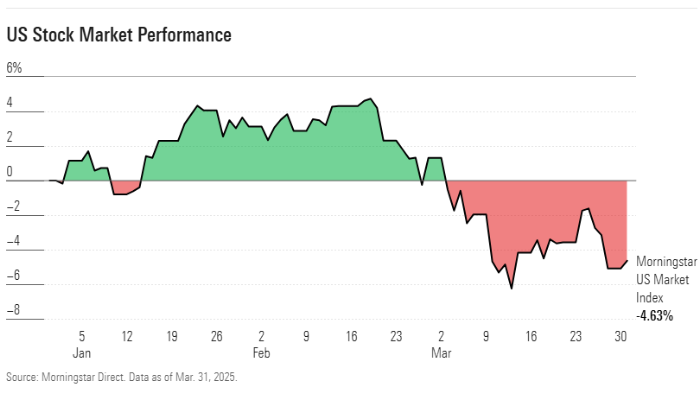

Q1 Market Update

Volatility: The first quarter of 2025 saw renewed volatility, with major indices posting modest declines.

Market Overview:

Volatility: The first quarter of 2025 saw renewed volatility, with major indices posting modest declines.

US Stocks: The S&P 500 fell by 4.27%, the Dow Jones Industrial Average by 0.87%, and the NASDAQ 100 by 8.07%. Concerns over trade policies and tariff threats weighed heavily on market sentiment.

International Markets: International stocks outperformed US stocks, driven by what we consider to be strong performance in Europe.

Sector Performance: Technology and consumer discretionary sectors faced sharp losses, while energy, healthcare, utilities, and consumer staples showed resilience. International Markets: International stocks outperformed US stocks, driven by what we consider to be strong performance in Europe.

Bond Market:

Performance: The bond market performed strongly, in our view, with the Morningstar US Core Bond Index gained 2.78% during the quarter. This was driven by falling interest rates across the Treasury yield curve, particularly in the two- to 10-year range.

High-Quality Bonds: Investors sought refuge in high-quality assets amid heightened market uncertainty. Treasury yields decreased, leading to a rally in prices for long-duration bonds like Treasuries and agency mortgages.

Credit Spreads: Credit spreads widened modestly from historically tight levels due to renewed concerns about tariffs and potential recession impacts.

Inflation-Protected Bonds: Inflation-protected bond funds gained 3.87% on average, benefiting from rising inflation expectations and falling Treasury yields.

Economic Overview:

Consumer Confidence: There was a sharp decline in US consumer confidence in the outlook for general economic conditions and inflation. One-year forward inflation expectations rose to 5%.

Personal Income: Wage and salary growth continued to exceed the general rate of inflation, supporting ongoing spending and increased savings. However, lower-income households faced budgetary stress due to higher prices on basic goods.

Employment: Robust job creation was a key factor in economic health, with nonfarm payrolls adding 151,000 jobs in February. However, the broader Household Survey of Employment showed a decline in jobs as the quarter progressed.

Federal Employment: Significant reductions in federal employment and spending were discussed and, in some cases, implemented. This is expected to have a pronounced local economic impact in future quarters.

Tariffs: The dominant economic story of the quarter was tariffs imposed and threatened. Steel and aluminum tariffs imposed in late February increased costs and slowed business activity in some sectors.

IMPORTANT DISCLOSURES

The opinions expressed herein are those of Ballast Advisors, LLC and are subject to change without notice. The third-party material presented is derived from sources Ballast Advisors consider to be reliable, but the accuracy and completeness cannot be guaranteed. Past performance is not indicative of future results. Nothing contained herein is an offer to purchase or sell any product. This material is for informational purposes only and should not be considered investment advice. Ballast Advisors reserve the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, legal, or retirement advice or recommendations. The information presented here is not specific to any individual's personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice. Ballast Advisors, LLC is a registered investment advisor under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training. More information about the firm, including its services, strategies, and fees can be found in our ADV Part 2, which is available without charge upon request. BAL-24-31